As payment volumes increase across payroll, vendor settlements, incentives, refunds, and partner payouts, finance teams are expected to manage large-scale disbursements with speed and precision. Handling these payouts individually often results in manual effort, delays, and limited visibility, especially as operations become more complex.

A structured approach to managing large-scale payments helps teams maintain accuracy, control, and consistency across recurring and time-sensitive payouts. When money moves at scale, having clarity over processes and outcomes becomes essential for smooth operations.

In this blog, you will learn how bulk payments are used across different business scenarios, the types of bulk payment formats organisations rely on, and how bulk payment processing works. You will also understand the benefits and challenges involved, explore real-world use cases across industries, and see how EnKash helps streamline bulk payments with better control and visibility.

What is Bulk Payment

Bulk payments allow organisations to send money to multiple recipients in a single payout cycle. Instead of processing individual payments one by one, finance teams can upload or trigger payouts together, ensuring faster execution and better control over large-scale disbursements.

This approach is commonly used for activities such as salary processing, vendor payments, partner payouts, incentives, refunds, and reimbursements. Internally, organisations often refer to this as bulk money movement because it simplifies fund distribution across multiple accounts.

In banking and system-level workflows, bulk payments are often executed via file-based or batch transfer mechanisms, also known as bulk transfers. For most business use cases, both terms refer to the same outcome: efficient and scalable payout execution.

Bulk payments also support structured formats such as bulk posting, bulk posting by salary during payroll cycles, bulk payouts to vendors or gig workers, and bulk deposits where funds are credited to multiple beneficiaries at once. This makes bulk payments a core component of modern finance operations as transaction volumes grow.

Types of Bulk Payments

Bulk payments are used across multiple business scenarios, and in the Indian financial ecosystem, they support large-scale payouts across payroll, vendors, and operational spends. While the objective remains the same, which is to transfer money to multiple recipients in one flow, the format and usage can differ based on operational needs.

Bulk Payout

Bulk payout is used when businesses need to disburse funds to a large number of recipients in a single cycle, including bulk vendor payments, partner commissions, incentives, refunds, and gig worker payouts.

Bulk Posting

Bulk posting refers to crediting amounts to multiple accounts or payment instruments through one upload or instruction, often used for payment execution as well as internal accounting and fund allocation. It is typically used in internal fund allocation and accounting processes where multiple credits need to be recorded simultaneously.

Bulk Posting by Salary

Bulk posting by salary is commonly used during payroll cycles to execute bulk salary payments efficiently and on time. Organisations upload employee-wise salary data and process payments together instead of initiating individual transfers. This approach supports timely salary disbursement while reducing manual effort and processing errors.

Bulk Deposits

Bulk deposits involve crediting funds to multiple beneficiary accounts in one process. In practical terms, bulk deposit meaning refers to depositing money into many accounts at the same time, often used for credit, incentives, refunds, or wallet credits.

How Bulk Payment Processing Works

Bulk payment processing follows a structured flow within a bulk payment processing system that helps businesses manage large-scale and recurring payouts with accuracy and control. The process typically involves the following steps:

- Preparation of payout data

Businesses compile beneficiary details such as bank account numbers, payment modes, and payout amounts based on the type of bulk payment being processed, including salaries, vendor payments, incentives, or refunds. - Upload of payment instructions

The payout file or payment instruction is uploaded through a centralized platform or dashboard instead of initiating individual transactions. - Data validation and checks

The system validates beneficiary details to identify errors, missing information, duplicates, or formatting issues. This helps reduce failed or incorrect payments before funds are released. - Debit from source account

Once validated, payouts are initiated from the source account based on the configured settlement and transfer mechanism. - Execution of individual payouts

Funds are routed to respective beneficiary accounts through supported banking or payment channels such as NEFT, IMPS, or internal ledger transfers in India, while being processed as part of one bulk flow. - Real-time status tracking

Businesses receive live updates on transaction statuses, including successful credits, pending payments, and failures, enabling quick corrective action when needed. - Reporting and reconciliation

Detailed reports are generated for audit and reconciliation purposes, helping finance teams track payouts, confirm receipts, and maintain accurate records.

Benefits of Bulk Payments for Businesses

Bulk payments offer several operational and financial advantages for businesses that manage frequent and large-scale payouts.

- Faster payment execution

Multiple payouts can be completed in a single flow instead of processing transactions individually, significantly reducing processing time. - Reduced manual effort

Centralised uploads and automated processing eliminate repetitive banking actions and minimise dependency on manual interventions. - Lower risk of errors

Automated validations and structured workflows reduce issues such as duplicate entries, incorrect amounts, or missed payments. - Better cash flow visibility

Businesses can view the total payout amount upfront and track transaction statuses in real time, improving financial planning and reconciliation. - Cost efficiency

Bulk processing lowers administrative overhead and reduces operational costs associated with repeated payment handling. - Improved scalability

As payout volumes increase, businesses can continue managing payments efficiently without changing processes or adding complexity.

Challenges in Bulk Payments and Best Practices to Manage Them

Bulk payments simplify large-scale payouts, but they also introduce challenges that need structured controls and processes. Below are common challenges and the best practices used to manage them.

Challenge |

What Goes Wrong |

Best Practice to Manage It |

|---|---|---|

Data accuracy issues |

Incorrect beneficiary details, duplicate entries, or formatting errors lead to failed or misdirected payments |

Use standardised payout templates, automated validations, and restricted manual inputs before submission |

Limited visibility during processing |

Finance teams cannot track individual transaction statuses once payouts are triggered |

Use a centralised dashboard with real-time status tracking for all payouts |

Approval delays |

Multiple approvers or unclear workflows slow down bulk payment execution |

Define clear approval hierarchies, payout thresholds, and role-based access controls |

Handling failed or partial transactions |

Failed credits increase reconciliation effort and delay payouts |

Set up automated retry mechanisms, failure reports, and structured reconciliation workflows |

Compliance and audit risks |

High-volume payouts lack proper documentation or traceability |

Maintain detailed transaction logs, timestamps, beneficiary records, and approval trails |

Reconciliation complexity |

Matching bank statements with hundreds or thousands of payouts becomes time-consuming |

Use system-generated reports and automated reconciliation tools |

Scalability constraints |

Existing processes break down as payout volumes grow |

Use systems designed to handle high-volume payouts without manual intervention |

How EnKash Helps in Bulk Payments

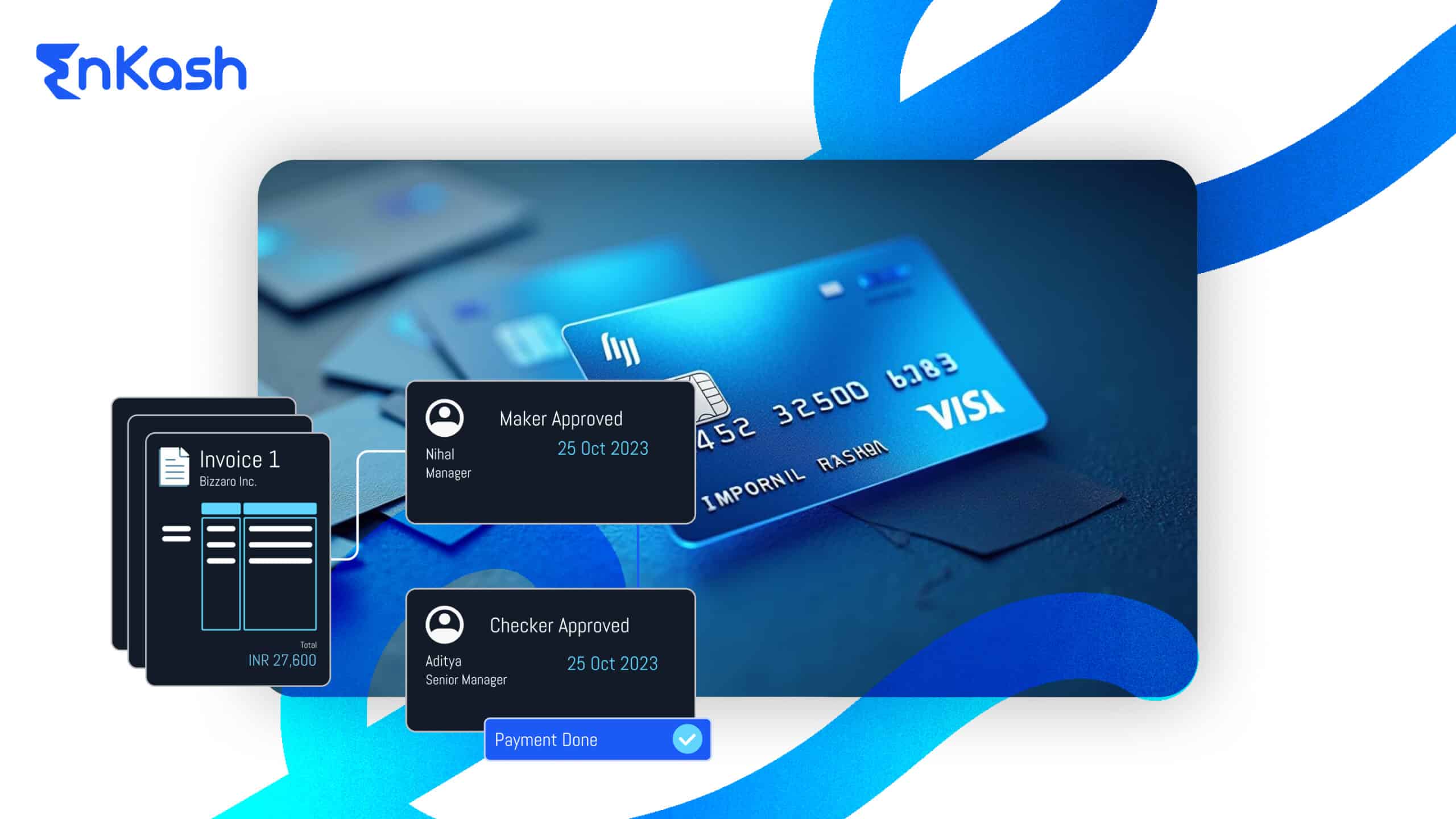

Managing bulk payments becomes significantly easier when businesses have a single platform to handle payout execution, controls, and visibility. EnKash supports bulk payment operations by simplifying how funds are prepared, processed, and tracked at scale. In India, bulk payments are routed through RBI-regulated payment systems, which makes compliance, audit readiness, and transaction traceability especially important.

EnKash enables businesses to process bulk payouts through a centralized dashboard, allowing finance teams to upload beneficiary details, define payout amounts, and execute transactions in one flow. This reduces dependence on manual banking processes and scattered tools.

The platform provides built-in validation checks to minimise errors before payouts are initiated. Incorrect details, duplicates, or missing information can be identified early, reducing payment failures and rework.

With real-time transaction tracking, businesses gain clear visibility into payout status across recipients. Finance teams can monitor successful credits, pending transactions, and failures from a single interface, making reconciliation faster and more accurate.

EnKash also supports structured approval workflows and access controls. Businesses can define who initiates, reviews, and approves bulk payments, ensuring accountability without slowing down operations.

By combining automation, visibility, and control, EnKash helps businesses manage bulk payments more efficiently while maintaining accuracy and operational discipline.

Use Cases of Bulk Payments Across Industries

Bulk payments are used across industries where businesses need to move money frequently, at scale, and with consistency. The ability to process multiple payouts together supports operational efficiency and reduces dependency on manual payment methods.

In manufacturing and supply chain businesses, bulk payments are commonly used to settle vendor invoices, transport charges, and distributor commissions. Processing these payments together helps maintain timely supplier relationships and smoother procurement cycles.

In retail and e-commerce, bulk payouts are used for seller settlements, customer refunds, cashback credits, and promotional incentives. High transaction volumes make bulk payment processing essential for maintaining speed and accuracy.

IT services, consulting firms, and professional services rely on bulk payments for payroll, contractor payouts, and performance-based incentives. Bulk posting by salary ensures employees and consultants are paid on time without manual intervention.

In the gig economy and platform-based businesses, bulk payouts support frequent payments to delivery partners, drivers, freelancers, and agents. These recurring payouts often run daily or weekly and require clear tracking and reconciliation.

Education and training institutions use bulk deposits for fee refunds, scholarships, stipends, and faculty payments. Managing these payouts in bulk reduces administrative effort and improves transparency.

In NBFCs and financial services, bulk payments are used for loan disbursements, customer refunds, and partner commissions. Accuracy and audit readiness are critical in these scenarios due to regulatory oversight.

Across industries, bulk payments play a key role in ensuring timely disbursements, operational control, and scalable money movement as transaction volumes grow.

Conclusion

So far, you have seen how bulk payments fit into larger financial workflows where efficiency, accuracy, and control matter at scale. As transaction volumes grow and processes become more interconnected, having structured ways to manage money movement helps reduce complexity and improve overall operational clarity. Across industries, bulk payments support multi-recipient and recurring disbursements by enabling smoother execution across high-volume activities.

Want a more structured way to manage bulk payouts at scale? Learn how EnKash helps streamline bulk payment operations.

FAQs

1. What is the meaning of bulk payment?

Bulk payment refers to the process of sending money to multiple recipients together instead of making individual transfers. It is commonly used for salaries, vendor payments, incentives, refunds, and other high-volume payouts.

2. Is bulk payment the same as bulk transfer?

In most business scenarios, yes. Both terms are used to describe sending funds to multiple beneficiaries in one flow. Bulk payment is the business-facing term, while bulk transfer may be used to describe the backend movement of funds.

3. What is bulk posting in payments?

Bulk posting involves crediting amounts to multiple accounts or payment instruments through a single upload or instruction. It is often used in internal accounting, fund allocation, and payroll processes.

4. What does bulk posting by salary mean?

Bulk posting by salary refers to processing employee salaries together in one cycle. Instead of individual transfers, employee-wise salary data is uploaded, and payments are executed in a single run.

5. What does bulk deposit mean in business payments?

Bulk deposit means depositing funds into multiple beneficiary accounts at the same time. This is commonly used for advances, incentives, refunds, or wallet credits.

6. Who should use bulk payment processing?

Bulk payment processing is useful for businesses that handle frequent or large-scale payouts, including enterprises, startups, platforms, NBFCs, and organisations managing payroll or vendor networks.

7. Are bulk payments secure?

Bulk payments can be secure and audit-ready when processed through platforms with strong validation, approval controls, and transaction tracking.