An Initial Public Offering (IPO) is the process through which a private company offers its shares to the public for the first time. It marks a major milestone in a company’s growth journey as it transitions from a privately held entity to a publicly listed one.

An IPO allows the business to raise fresh capital from investors, improve its market visibility, and strengthen its financial position.

When the shares of a company are offered in the capital markets (stock exchanges) for trade, it is known as an Initial Public Offering or IPO. The shares are commonly offered to institutional and retail investors (i.e., individuals).

Companies go public through an IPO to fund expansion, launch new projects, reduce existing debt, or improve overall corporate credibility. By issuing IPO shares, businesses gain access to a larger pool of investors, which can significantly boost their valuation and long-term growth prospects.

What is an IPO?

The IPO full form is Initial Public Offering.

What are IPO Shares?

IPO: Key Points

- A company and its existing shareholders offer fresh and existing shares to the public in exchange for capital, and the company then uses this capital for growth

- Once the company is public, it gives them a good shot at building a brand since IPOs are covered by the media extensively

- The approval for an Initial Public Offering, i.e., listing on stock exchanges, is granted by a regulatory authority, and in India, it is the Securities and Exchange Board of India (SEBI)

- It is a perfect opportunity for the company to create wealth for the key stakeholders

- Going public has its benefits for the employees who have ESOPs as well as they can publicly trade their shares after exercising

- The fixed price for an IPO is determined based on the number of bids at different price points and the valuation of the Company.

- The company gets valuable leverage for negotiating lower interest rates on loans for future needs.

Why Companies Issue an IPO

Companies issue an IPO (Initial Public Offering) to raise fresh capital and unlock new growth opportunities. By offering shares to the public for the first time, a business gains access to a bigger investor base and improves its financial position.

These are the major reasons why companies issue their Shares to the Public:

1. Raising Capital for Growth

The primary objective of an IPO is to raise capital for business expansion, product development, or market diversification. Companies use this capital to scale their business, invest in technological improvements, expand into new markets, launch new products, or build better manufacturing capacity. IPO funding helps businesses accelerate their long-term growth plans without relying solely on bank loans.

2. Expanding Operations

Going public allows a company to fund large-scale expansion projects. Whether it’s opening new branches, improving technological infrastructure, or increasing the capacity of production, IPO proceeds help businesses grow faster and more efficiently.

3. Improving Brand Visibility & Market Credibility

A successful IPO significantly boosts a company’s brand recognition. Listing on major stock exchanges like NSE or BSE adds credibility, improves customer trust, and positions the company as a strong market player. Enhanced visibility also attracts strategic partnerships and top talent.

4. Reducing Debt Burden

Many companies use IPO funds to reduce or restructure existing debt. Lower debt improves financial stability, strengthens the balance sheet, reduces interest expenses, and increases profitability—making the company more attractive to investors.

5. Achieving Better Market Valuation

An IPO helps a company discover its true market value through public investors. The listing process provides transparency, increases the liquidity of shares, and creates opportunities for future fundraising. Higher valuation also benefits existing shareholders and founders.

What are IPO Compliance Requirements?

Compliance Area |

Revised Description |

SEBI Regulatory Norms |

The company must follow SEBI ICDR guidelines and submit mandatory documents like DRHP, RHP, and financial statements to ensure full transparency. |

Verification & Auditing |

Merchant bankers carry out financial, legal, taxation, and operational checks along with compulsory audits to validate company information. |

Corporate Governance Standards |

Requires appointing independent board members, forming audit/risk committees, and maintaining clear governance practices. |

Investor KYC & Anti-Money Laundering Rules |

Includes PAN validation, Demat verification, bank authentication, and compliance with AML measures for secure investor onboarding. |

Post-Listing Reporting Duties |

Involves publishing quarterly earnings, shareholding updates, and event disclosures as per stock market regulations. |

Stock Exchange Listing Conditions |

The company must meet NSE/BSE eligibility benchmarks such as minimum profitability, net worth, and documentation requirements. |

Promoter Lock-In Conditions |

Promoters must follow SEBI’s lock-in guidelines to ensure stability in shareholding after the IPO. |

Disclosure of Fund Utilization |

The prospectus must clearly outline how the IPO money will be used, including project details and allocation plans. |

Eligibility Criteria for Filing an IPO

Below are the most important requirements for filing an IPO:

- The company should have existed for at least three years

- Having a PAN and a Demat account is essential for filing an IPO

- The net worth of the company should be positive

- After the IPO, at least 25% of the company’s shares must be held by the public as per SEBI’s minimum public shareholding norms

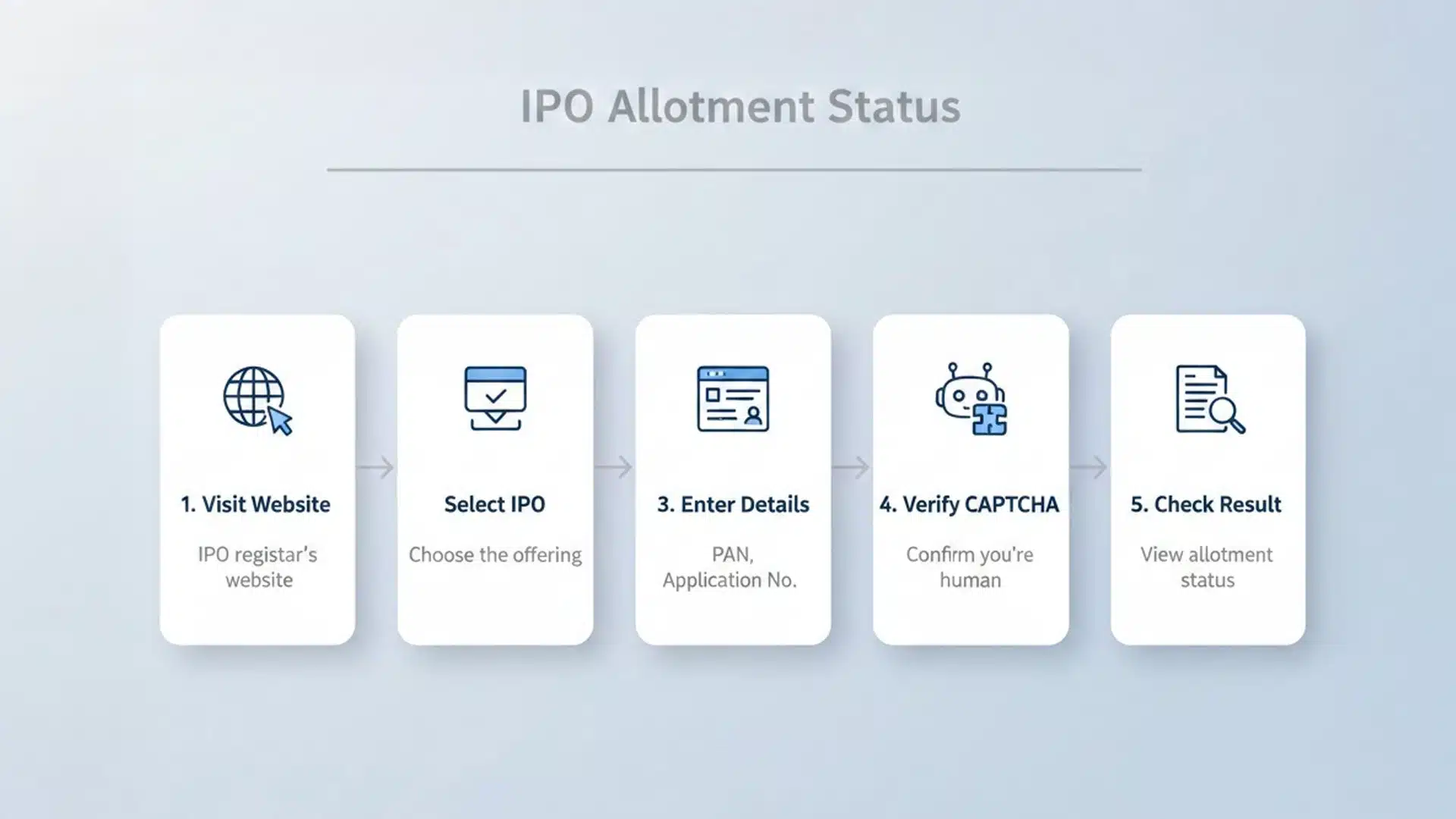

How to Check IPO Allotment Status?

What is the IPO Cycle?

Before an IPO is approved, it undergoes a long process by the regulatory authority to determine eligibility for filing an IPO. The steps involved are as follows:

1. Filing IPO Application with SEBI: To start the Initial Public Offering process, applying with SEBI along with all the relevant details is necessary, such as:

- Number of shares to be issued

- The price set (in case it is a fixed price IPO)

- Previous records of the company

- Proposed use for the funds to be raised, etc.

2. Appointing an Investment Bank: (also called the Lead): The investment bank manages the IPO and acts as an intermediary between the company, SEBI, and investors. They guide the company in raising capital and act as intermediaries between the company and its investors. They are also an intermediary between the Company and SEBI. T

3. Filing of Draft Red Herring Prospectus: The company files a Draft Red Herring Prospectus (DRHP) with SEBI. After SEBI’s observations, the final Red Herring Prospectus (RHP) is issued before the IPO opens..

4. Roadshows: Before the IPO is open to the public, companies usually create a buzz in the market by advertising the impending IPO across the country via various presentations to help investors better understand the positive aspects of the particular IPO.

5. Deciding the IPO Price: As the next step, the company initiates the IPO price through a Fixed Price IPO or Book-Binding offering.

6. Launching the IPO: The company launches the IPO after finalizing the size and brand. It is the responsibility of the lead manager to contact all potential investors.

7. Allotment of Shares: As the last step in the IPO process, shares are allotted to the investors based on the bids made. The allotment process is done through a computerized system, which ensures that the shares are fairly priced.

What Is Flotation Cost in an IPO?

Flotation cost refers to the total expenses a company incurs while raising capital through an Initial Public Offering (IPO).

These costs include underwriting fees, legal charges, compliance expenses, listing fees, marketing spend, and administrative charges required to take a company public. Flotation cost directly affects the net proceeds received from the IPO and can influence the company’s valuation and final share price.

Because going public involves multiple regulatory and financial processes, companies must plan flotation costs carefully to ensure a smooth and successful IPO launch.

Flotation Cost Components

Flotation Cost Components |

Description |

|---|---|

Underwriting Fees |

Payments are made to investment bankers for managing, marketing, and underwriting the IPO issue. |

Legal & Compliance Charges |

Costs for legal documentation, agreements, regulatory filings, and SEBI compliance. |

Audit & Due Diligence Fees |

Expenses for financial audits, risk assessments, and due diligence reports. |

Registrar & Processing Fees |

Fees paid to registrars like Link Intime or KFin for investor applications and allotment processing. |

Listing Fees (Stock Exchanges) |

Charges for listing shares on NSE, BSE, and meeting exchange requirements. |

Marketing & Advertising Costs |

Expenses for IPO roadshows, branding, PR campaigns, and investor awareness. |

Printing & Documentation |

Cost of printing prospectus, offer documents, and corporate communication material. |

Administrative & Miscellaneous Costs |

Internal operational costs related to IPO planning, coordination, and management. |

IPO Investment: How Investors Can Invest in IPO?

Investing in an IPO allows individuals and institutions to buy shares of a company before it is listed on the stock exchange. Understanding how IPO investment works helps investors make informed decisions and improve their chances of allotment.

1. How to Apply for an IPO

To invest in an IPO, investors can apply through:

- ASBA (Applications Supported by Blocked Amount) via their bank

- UPI-based IPO applications through stockbroker apps

- Net-banking or Demat account portals.

You must have a Demat account, a verified PAN, and an active bank account to place a bid.

2. ASBA Process

The ASBA process ensures investor funds remain blocked in their bank account until allotment.

Steps involved:

- Select the IPO you want to invest in.

- Enter the number of lots and bid amount.

- Your bank blocks the amount without deducting it.

- If shares are allotted, the blocked amount is debited; otherwise, it is released.

ASBA protects investors from unnecessary fund transfers and makes IPO investing safer.

3. Types of IPO Investors

IPO participation is divided into regulated investor categories:

- Retail Individual Investors (RII): Small individual investors applying up to ₹2 lakh.

- High Net-worth Individuals (HNI/NII): Investors applying above ₹2 lakh.

- Qualified Institutional Buyers (QIB): Mutual funds, banks, insurance companies, FPIs.

Each category has a fixed percentage of shares reserved, improving allocation fairness.

4. Risks and Returns of IPO Investment

IPO investment offers the potential for high returns if the stock lists at a premium. However, it carries risks such as:

- Market volatility is affecting the listing price

- Oversubscription leading to low allotment probability

- Company fundamentals not performing as expected

Investors must evaluate financials, business models, and risk factors before investing to make informed decisions.

Conclusion

The Initial Public Offering (IPO) market plays an important role in empowering economic growth by helping companies raise capital, expand their business operations, and improve corporate governance. For investors, IPOs offer early access to high-potential companies and the opportunity to generate long-term wealth, making them an important part of modern investment strategies.

For businesses planning to go public, strong regulatory compliance, transparent financials, and investor trust are very important for a successful listing on the public offering. For investors, careful evaluation of a company’s fundamentals, risks, and market conditions helps in making better IPO investment decisions.

Looking ahead, the Indian IPO market is expected to grow steadily, supported by digital platforms, strong investor participation, and favorable regulatory reforms. As more startups and established enterprises explore public listings, IPOs will continue to shape India’s financial landscape and create new opportunities for both companies and investors.

Frequently Asked Questions

1. What does the price band mean in an IPO?

The Price Band refers to the lower and upper limit of the share price within which the company decides to offer its shares to the public. The investors can bid equal to or between these lower and upper limits.

2. Can I apply for multiple IPOs from the same name and company?

No, multiple applications are not accepted by SEBI for IPO.

3. Who are Investment Banks?

An Investment Bank is an independent financial institution appointed by the company going public to manage the IPO on its behalf. They are also called Book Running Lead Managers and are registered with SEBI to act as an intermediary between SEBI and the Company.

4. What is a Red Herring Prospectus?

A red herring is a preliminary prospectus filed by a company in connection with the company’s initial public offering (IPO).

5. What are the costs associated with an IPO?

The costs associated with an IPO include underwriting fees, legal charges, audit expenses, SEBI compliance fees, registrar charges, stock exchange listing fees, marketing costs, and administrative expenses. These expenses together are known as flotation costs and reduce the net funds raised from the IPO.

6. Which is the biggest IPO in India?

The biggest IPO in India to date is Paytm (One97 Communications), which raised ₹18,300 crore during its public issue. It remains the largest IPO in Indian stock market history.

7. How to cancel IPO allotment?

You cannot cancel IPO allotment after shares are allotted. However, you can cancel your IPO application before the allotment date by:

- Logging into your broker app or net banking

- Going to the IPO section

- Canceling or deleting your bid

Once allotment is done, you can only sell the shares after listing.

8. How much can a retail investor invest in an IPO?

A retail investor can invest up to ₹2 lakh in an IPO under the Retail Individual Investor (RII) category, as per SEBI guidelines.

9. What is the minimum limit of retail investors in an IPO?

The minimum limit for a retail investor is one lot, which varies for each IPO. The lot size is decided by the company and usually ranges between ₹10,000 to ₹15,000 for small issues and higher for premium IPOs.

10. What is IPO’s full form?

IPO full form is Initial Public Offering, which refers to the process where a company offers its shares to the public for the first time to raise capital.

11. What is the IPO Cycle?

The IPO cycle is the complete process of going public, which includes:

- Appointing merchant bankers

- Preparing DRHP/RHP

- SEBI review and approval

- Investor roadshows

- Opening the public issue

- Allotment of shares

- Listing on the stock exchange

12. What is the GMP of IPO?

IPO GMP stands for “Grey Market Premium”, which indicates how much the IPO shares are trading for in the unofficial grey market before listing. GMP helps investors estimate possible listing gains, though it is not regulated.

13. How to apply for IPO in Zerodha?

To apply for an IPO in Zerodha:

- Log in to Kite or Console

- Go to the IPO section

- Select the IPO you want to apply for

- Enter lot size and bid price

- Enter your UPI ID

- Approve the mandate in your UPI app

Your application will be submitted instantly.

14. How does IPO allotment work?

IPO allotment is done based on SEBI’s fair allotment process, which includes:

- Allotment via the lottery system is oversubscribed

- Priority to retail investors in smaller issues

- Category-based share reservation

- Proportional allotment for institutional categories

- Investors receive shares only if their application is selected during the allotment process.

15. What is LIP in IPO?

LIP in IPO refers to “Listing Price”, which is the initial price at which the company’s shares start trading on the stock exchange after the IPO listing.

16. How to increase chances of IPO allotment?

To increase your chances of IPO allotment:

- Apply using multiple Demat accounts of family members

- Bid at the cut-off price

- Avoid last-minute bidding

- Apply through ASBA for smooth processing

- Prefer small and medium IPOs, which have better retail allotment chances

- Ensure UPI mandates are approved on time