Introduction

Every big business often begins with just one person and an idea. Someone who believes they can turn that idea into something bigger, a brand, a company, a success story.

But in the early stages, running a business alone isn’t always easy. Managing customers, money, and compliance can feel overwhelming, especially when you don’t have a team or partner to share the load.

That’s why India introduced a way for solo founders to start and run a company legally, without needing anyone else’s name on the papers. A model that gives you the freedom to own 100% of your business while enjoying the benefits of being a registered company.

We’ll explore this concept, known as the One Person Company, in detail throughout this blog.

What is a One Person Company (OPC)?

A One Person Company, often called OPC, is a type of business structure that allows a single individual to start and manage a company on their own.

It was introduced under the Companies Act, 2013, to give solo entrepreneurs the benefits of a registered company, like legal recognition, limited liability, and easier access to loans or funding without the need for multiple directors or shareholders.

In an OPC, one person is both the owner and director. They make all decisions and enjoy complete control, while their personal assets remain protected even if the business incurs losses.

Think of it as a blend between a sole proprietorship and a private limited company, combining independence with legal security.

Read More: What is Comapany and Its Types

Eligibility and Basic Requirements for a One-Person Company

Before registering a One Person Company (OPC) in India, you must meet a few basic eligibility criteria.. These help ensure that the company is compliant under the Companies Act, 2013, and suitable for individual founders.

1. Only One Shareholder

An OPC can have only one person as a shareholder or member. This individual holds full ownership of the company.

2. Indian Citizenship and Residency

The shareholder must be an Indian citizen and a resident of India, meaning they should have lived in India for at least 120 days in the previous financial year.

3. One OPC at a Time

A person can register only one One Person Company and cannot incorporate more than one OPC or act as a nominee in more than one OPC at the same time.

4. Nominee Appointment

A nominee must be appointed during registration. This person will take over the company if the original owner is unable to manage it.

5. Registered Office Address

Every OPC must have a valid business address in India for receiving official communication and notices.

6. Minimum Capital

There’s no minimum capital requirement to start an OPC, but many companies begin with ₹1 lakh as authorized capital.

These simple rules make the OPC structure ideal for solo founders who want the flexibility of owning their business entirely while remaining legally compliant.

Documents Required for OPC Registration

To register a One Person Company (OPC) in India, you’ll need to submit a few essential documents. Having these ready in advance makes the process faster and smoother.

1. Personal Documents of the Owner and Nominee

- PAN card (mandatory for Indian citizens)

- Aadhaar card

- Proof of identity – Passport, Voter ID, or Driving License

- Recent passport-size photograph

2. Proof of Address

Latest utility bill, telephone bill, or bank statement (not older than 2 months)

3. Registered Office Documents

- Proof of ownership or rent agreement for the office address

- No Objection Certificate (NOC) from the property owner if the place is rented

4. Company-Related Documents

- Memorandum of Association (MOA) – defines your company’s objectives

- Articles of Association (AOA) – outlines how the company will operate

- Consent of Nominee (Form INC-3) – signed declaration from the nominee agreeing to take over if needed

Once these documents are submitted through the MCA portal using the SPICe+ form, the Registrar of Companies (ROC) verifies them and issues the Certificate of Incorporation. That’s when your OPC officially comes into existence.

How to Register a One-Person Company in India

Setting up a One Person Company (OPC) is simple if you follow the right steps. The entire process can be done online through the Ministry of Corporate Affairs (MCA) portal. Here’s how it works:

1. Get a Digital Signature Certificate (DSC)

Since the registration is done online, the first step is to get a DSC for the company’s director. This acts as a digital version of your signature for filing documents.

2. Apply for a Director Identification Number (DIN)

Next, apply for a DIN, which is a unique ID issued by the government to anyone who wants to become a company director in India.

3. Choose a Name for Your Company

Select a unique and suitable One Person Company name that reflects your business. You can check its availability and reserve it on the MCA website.

4. File Incorporation Documents

Once the name is approved, submit all required documents such as the Memorandum of Association (MOA), Articles of Association (AOA), proof of address, and identity details of the director and nominee.

5. Get the Certificate of Incorporation

After verification, the Registrar of Companies issues a Certificate of Incorporation. This officially means your OPC is registered and ready to operate.

Once registered, your OPC gets a PAN and TAN, and you can open a bank account in the company’s name to start business transactions.

Advantages of a One-Person Company

A One Person Company (OPC) gives solo entrepreneurs the comfort of working independently while enjoying the legal benefits of a registered business. Here are some of its main advantages:

1. Limited Liability

The owner’s personal assets are protected. If the company faces losses or debts, only the amount invested in the business is at risk, not personal savings or property.

2. Full Control and Ownership

Unlike other company types, an OPC has just one member who makes all decisions. This means faster actions and no need for approvals from multiple partners or shareholders.

3. Separate Legal Identity

An OPC is a distinct legal entity under the Companies Act, 2013. It can own property, enter into contracts, and open a bank account in its own name, separate from the individual who runs it.

4. Better Credibility

Registered companies inspire greater trust among clients, banks, and investors. It’s easier for an OPC to raise loans, apply for tenders, or collaborate with other businesses compared to a sole proprietorship.

5. Continuous Existence

Even if the owner is unable to continue, the nominee (appointed during registration) can take over. This ensures smooth business continuity.

6. Ease of Conversion and Compliance

An OPC can later be converted into a Private Limited or Public Limited Company once it grows. The compliance requirements are simpler than larger companies, making it easier to manage.

Difference Between One Person Company and Private Limited Company

Both a One Person Company (OPC) and a Private Limited Company (Pvt Ltd) are popular business structures in India, but they differ in ownership, compliance, and flexibility.

Understanding these differences helps founders choose the right model for their goals.

Criteria |

One Person Company (OPC) |

Private Limited Company (Pvt Ltd) |

Ownership |

Owned by a single person |

Minimum 2 shareholders required |

Directors |

Can have 1 to 15 directors |

Must have at least 2 directors |

Decision Making |

Quick and independent |

Shared among directors and shareholders |

Compliance |

Fewer compliance requirements |

Higher compliance and reporting |

Liability |

Limited to the owner’s investment |

Limited to each shareholder’s investment |

Conversion |

Can be converted into a Private Limited after growth |

Already structured for multiple owners |

Ideal For |

Solo founders, freelancers, and professionals |

Startups or companies with co-founders and investors |

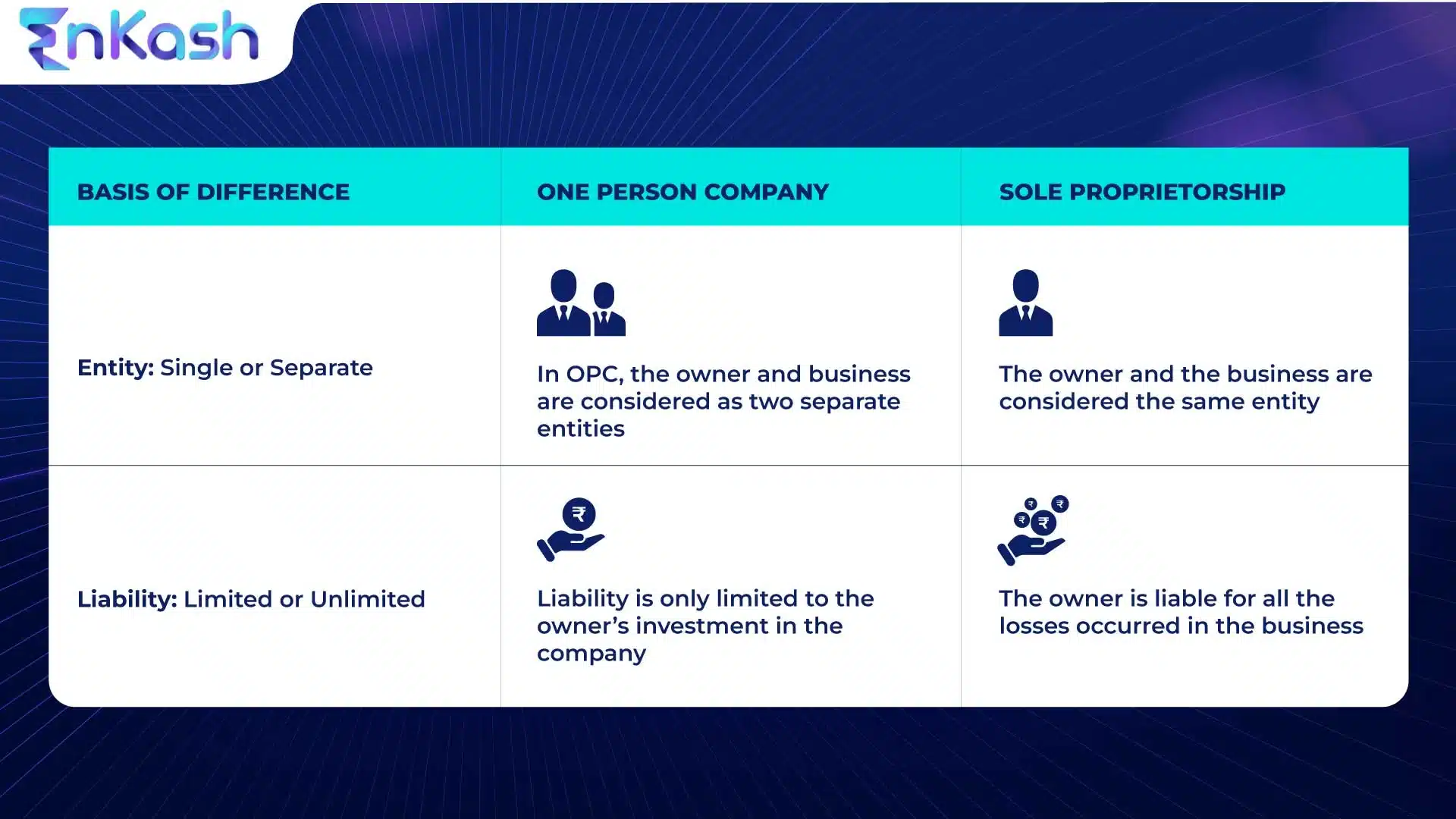

Difference Between One Person Company and Sole Proprietorship

Often, there’s confusion between One Person Company and Sole Proprietorship in terms of ownership, liability, and more. Below are key differences between the two:

Factor |

OPC (One Person Company) |

Sole Proprietorship |

|---|---|---|

Definition |

A separate legal entity formed under the Companies Act with a single shareholder. |

An unregistered business owned and controlled by one individual. |

Legal Status |

Separate legal entity distinct from the owner. |

No separate legal entity; owner = business. |

Liability |

Limited liability – owner’s personal assets are protected. |

Unlimited liability – owner’s personal assets can be used to repay business debts. |

Registration |

Mandatory registration with MCA (Ministry of Corporate Affairs). |

No formal registration; it can be started with basic licenses. |

Compliance Requirements |

High – annual filings, audits, and board meetings. |

Very low – minimal compliance and documentation. |

Taxation |

Taxed as a company (corporate tax). |

Taxed as per individual income tax slabs. |

Ownership Transfer |

Easy share transfer and nomination facility. |

Not easily transferable; the business ends with the owner. |

Perpetual Existence |

Continues even if the owner dies (due to the nominee). |

Ends with the owner; no perpetual succession. |

Fundraising |

Easier – better credibility for loans and investors. |

Harder – limited credibility and fewer fundraising options. |

Brand Image |

More professional and trustworthy. |

Relatively informal business structure. |

Best For |

Solo entrepreneurs want limited liability and a formal structure. |

Small traders, freelancers, and local businesses want simplicity. |

OPC Tax Rate and Compliance Requirements

Just like any other registered company, a One Person Company (OPC) also needs to pay taxes and follow certain compliance rules under Indian law. The good news is the tax structure for OPCs is simple and similar to that of a Private Limited Company.

1. OPC Tax Rate

The corporate tax rate for a domestic OPC is 25% (plus surcharge and cess) if its turnover in the previous financial year is below ₹400 crore.

- If turnover crosses ₹400 crore, the tax rate becomes 30%.

- In addition, a cess of 4% is applied on the total tax amount.

The new tax regime applies to domestic companies, including OPCs, which offers a 22% tax rate (plus cess and surcharge) without claiming certain deductions or exemptions.

2. Annual Compliance

An OPC must:

- File Income Tax Returns (ITR) every year.

- Submit annual financial statements and annual return to the Registrar of Companies (ROC) through forms AOC-4 and MGT-7A.

- Conduct at least two board meetings in a financial year.

- Get accounts audited by a Chartered Accountant.

3. GST and Other Registrations

If the company’s turnover crosses the threshold limit (₹40 lakh for goods or ₹20 lakh for services), it must register for GST. Other registrations, like Professional Tax or Shops and Establishment License, may apply depending on the business type and location.

These compliances keep your OPC legally valid, transparent, and eligible for government benefits and funding opportunities.

Conclusion

A One Person Company (OPC) is a great choice for individuals who want to run their own business with full control yet enjoy the protection of a registered company. It combines the simplicity of a sole proprietorship with the legal structure and credibility of a private limited company.

With limited liability, easy registration, and legal recognition, OPCs have become a popular way for solo founders and freelancers to grow confidently under their own name.

Whether you’re an independent professional or a budding entrepreneur, registering a single director company can be your first step towards building a strong, scalable, and legally secure business in India.

FAQs

1. Can a One Person Company have more than one director?

Yes. While an OPC can have only one shareholder, it can appoint up to 15 directors as per the Companies Act, 2013.

2. Who can register a One Person Company in India?

Any Indian citizen and resident (who has stayed in India for at least 120 days during the previous financial year) can register an OPC.

3. Is GST registration mandatory for an OPC?

Not always. GST registration is required only if the company’s annual turnover exceeds ₹40 lakh (for goods) or ₹20 lakh (for services), or if it deals in inter-state supply.

4. Can an OPC be converted into a Private Limited Company?

Yes. Once an OPC crosses ₹2 crore in paid-up capital or ₹20 crore in annual turnover, conversion into a Private Limited Company becomes mandatory. The owner can also choose to convert voluntarily.

5. What is the OPC tax rate in India?

An OPC pays 25% corporate tax (plus surcharge and cess) if turnover is below ₹400 crore. Under the new tax regime, the rate can be 22% (without exemptions).

6. What is the full form of OPC?

OPC stands for One Person Company, a business structure introduced under Section 2(62) of the Companies Act, 2013.