The way we do business has changed a lot since the demonetization and the lockdown due to the pandemic. While the process of digital transactions has become more accessible, easier, and secure than ever, there are some areas that many of us may not be aware of even now.

In this blog, we will look at what chargebacks mean and why it is critical for all businesses to be aware of them, especially for startups and smaller companies. It is essential to learn about chargebacks, how to claim them (for customers), how to prevent them (for merchants), and other details.

What is a chargeback?

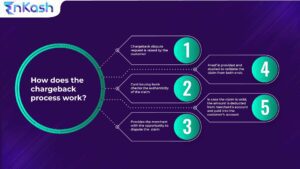

As the term suggests, a chargeback is the return of money to a customer, usually involving an online transaction using a debit or credit card. In most cases, it is a dispute that the customer raises with the bank that has issued the card, which, in turn, requests the merchant to reverse the payment.

Here are some examples of chargeback instances:

Example 1: The goods that the customer has received are damaged and the customer takes this up as a reason for a chargeback.

Example 2: Customer made the payment but it is not reflecting and does it again to ensure the transaction is complete. However, both payments go through and the customer ends up paying twice. This is another instance of a chargeback being raised.

Chargebacks vs refunds and how they are different. Often chargebacks are confused with refunds. But the fundamental difference between chargebacks and refunds is that refunds are claimed from the merchant and chargebacks are claimed from the bank.

In some instances, if the merchant or seller rejects the refund request, the customer may appeal to the bank to facilitate a chargeback. Usually, the process of chargeback takes longer than the refund.

What are the possible causes of chargebacks?

Poor quality or damaged product: A customer may often request a chargeback when the product quality is not as described at the time of purchase. Or if the product is different in terms of specifications from when the purchase was made.

Product shipping issues: When the product is lost or damaged during the shipping process or delayed beyond a reasonable time, then the customer may request a chargeback.

Delayed refund: The customer is not happy with the purchase and has requested a refund, which the merchant has either not responded to or refused, then the customer may request a chargeback.

Unauthorized card transaction: The customer may raise a chargeback when there is unauthorized or improper use of the credit card or debit card.

Technical issues: In some instances, there could be cases of incorrect or duplicate billing, for which the customer has paid more than the billing amount. In such instances, the customer may raise a chargeback request.

How do chargebacks affect the seller or merchant?

If a merchant or seller has too many instances of chargebacks, it is going not only to affect the merchant in terms of cash flow but also affect their reputation. What is more, there are penalties that are associated with the chargeback that will be applied, causing further damage.

What best practices can merchants or sellers adopt to avoid high volume of chargebacks?

The key to avoiding too many chargeback requests is to establish a solid infrastructure in terms of payment and ensure that all the goods and services delivered are of good quality.

The other best practices include:

Detailed information: Merchants or sellers need to provide detailed information about the order paid for, to the customer. This way any confusion about the quality, quantity, specifications, and pricing can be avoided.

Order confirmation: The merchant can also ask customers for an explicit confirmation of the order before starting the packing and dispatching processes. This way, any changes the customer wants can be made before dispatch.

Regular updates: In an online world where convenience is the key motivation, often mistrust also lurks behind the minds of customers. One of the easiest ways to mitigate this is by updating customers on a regular basis. Explicit information given upfront can help avoid chargebacks.

Take measures: Merchants also need to ensure that they keep a lookout for red flags like a repetitive pattern from customers or many cards being used for orders to be delivered to the same address, and so on.

Chargebacks are a part of online transactions and have been enabled to protect the interest of customers, but there’s a chance it can be misused. Information updates, ethical business practices, and robust technology can help optimize the occurrence of too many chargebacks and minimize the associated costs.

Gurgaon Mumbai Pune Bengaluru

Gurgaon Mumbai Pune Bengaluru