Digital commerce has become the new normal with businesses going online faster than ever and customers being accustomed to seamless, one-click experiences. From startups to enterprises, everyone is rushing to make it big online. However, a robust, secure, and feature-rich payment gateway is at the heart of any successful online business. That’s where EnKash steps in.

Over the years, EnKash has consistently tackled complex business challenges with its advanced products and solutions. The industry-led expertise and innovation-first mindset have always powered our approach to problem-solving skills at EnKash. It’s the same vision that led to the development of EnKash Payment Gateway, built from the ground up to address real-world gaps. From streamlining bill payments to simplifying expense management, we recognized a growing need for a smarter, more intuitive payment solution and brought it to life.

Why SMBs Need a Powerful Payment Gateway

Every transaction is crucial for SMBs and startups, which is reason enough for them to have a dependable, secure, and scalable payment gateway. SMBs and startups in their growth era need to build trust, reduce drop-offs, and provide a frictionless experience for their customers. The need for automated reconciliation, instant settlements, real-time insights, and multiple payment options as provided by an advanced payment gateway becomes indispensable to meet the modern customer’s needs and facilitate conversions for business.

Challenges with Traditional Payment Systems

Long Settlement Cycles

Traditional payment gateways take their sweet time for funds to reflect in your account. That’s not sustainable for today’s fast-paced businesses that run on real-time cash flow.

Complex Integrations

Tech is that not developer-friendly systems make integration a nightmare, especially for startups with lean tech teams.

Limited Payment Options

Conventional payment gateways often support only a few modes, like cards or net banking, missing out on UPI, wallets, or BNPL.

Hidden Fees and Poor Transparency

Often, these payment gateways have hidden charges and unclear pricing structures, leaving businesses confused and frustrated.

Weak Support and Downtime Issues

When things go wrong, support disappears. And worse, downtime during peak business hours can mean lost revenue and trust.

Lack of Real-Time Insights

Traditional systems rarely offer data dashboards or actionable insights, leaving businesses blind to key payment trends and issues.

Customer Expectations Around Smooth Payment Experiences

Faster = Better

Click, and it’s done—this has become second nature to customers today. A slight delay can lead to instant cart abandonment.

Multiple Choice, More Conversions

Customers want to choose their payment mode — UPI, EMI, wallets, and BNPL. They want flexibility.

Security Without Compromise

Customers want their data to be safe. A secure yet intuitive experience is the new benchmark.

Transparency

Post payment transparency for real-time confirmation, instant refunds, and clear transactions has become essential today.

Introducing: EnKash Payment Gateway

EnKash Payment Gateway is an advanced solution designed specifically for Indian SMBs and startups. It empowers businesses of all sizes to accept payments seamlessly, securely, and at scale, giving them a fair chance to compete in a rapidly growing digital economy.

How Does EnKash Payment Gateway Work? (A step-by-step process)

EnKash Payment Gateway is a secure, intelligent bridge between your customer’s preferred payment method and your business account. It validates transactions, encrypts data for secure processing, ensures quick settlements, and offers full visibility via a centralized, intuitive dashboard. From the moment a customer clicks “Pay” to when the funds reflect in your account, EnKash streamlines it all.

Step 1: Customer Makes a Payment

The payment gateway process commences when a customer selects a product or service and clicks “Pay” on the website or app.

Step 2: Secure Data Transfer

The payment gateway encrypts the customer’s payment details securely and sends the data to the acquiring bank.

Step 3. Transaction Authorization

The acquiring bank sends the request to the customer’s issuing bank (or card network like Visa/Mastercard) to verify details and check for sufficient funds.

Step 4. Approval or Decline Response

The issuing bank responds either by approving or declining it through the same route: card network → acquiring bank → payment gateway → merchant site.

Step 5. Payment Confirmation

The customer gets a confirmation message if the payment is approved and the order is successfully placed.

Step 6. Funds Settlement

The approved amount is settled into the merchant’s account by the acquiring bank within a defined settlement window.

Step 7. Dashboard Visibility

The merchant can view and track the entire transaction lifecycle in real-time through the EnKash dashboard, including settlements, refunds, and reconciliations

EnKash Payment Gateway: Key Features

Effortless Integration Across Platforms

Easily integrate EnKash payment gateway across leading e-commerce platforms like Shopify, WooCommerce, Magento, Prestashop, WHMCS, CS Cart, or even your custom-built stack. Use powerful APIs, SDKs for wallets and banks, and no-code plugins to build fast and scale effortlessly.

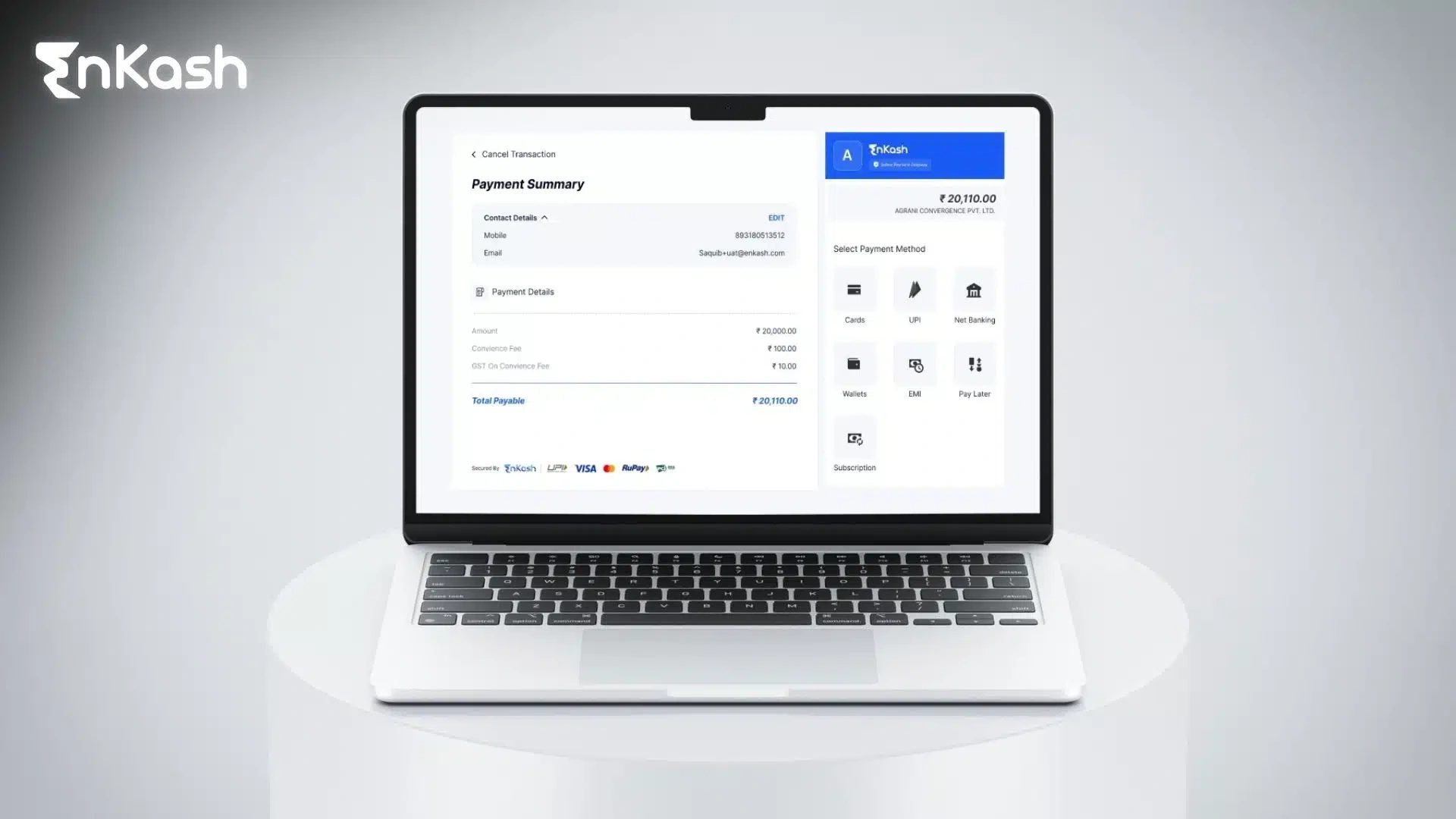

100+ Payment Methods

Your customers get unmatched flexibility with support for UPI payments, cards, net banking, wallets, BNPL, EMI, Autopay, and QR code, making it easier to make payments on their terms, every time.

One Dashboard, Complete Control

EnKash Payment Gateway is not just for collecting payments. Businesses can use it to track payments, monitor refunds, reconcile faster, and get actionable business insights, all from one intuitive dashboard.

Bank Grade Security

PCI DSS Compliance, end-to-end encryption, tokenization, and real-time threat assessments— all these ensure complete peace of mind for you and your customers.

Robust Language Support

EnKash Payment Gateway is developer-friendly and supports multiple programming languages, including cURL, PHP, Java, Go, Python, and C++.

Fully Customizable Experience

EnKash Payment Gateway allows you to tailor every aspect of the payment journey from checkout flow to branding, ensuring a seamless, on-brand experience for your customers. Customize it to match your business logic, UI preferences, and customer needs without compromise.

Real Human Support, 24/7

No chatbots. No scripted delays. Just real, experts ready to help whenever you need it. Our dedicated support team and relationship managers ensure you’re never left guessing, whether it’s during integration or scaling.

100% Uptime, Always

Our enterprise-grade infrastructure is built for performance and resilience. Even during high-traffic events or peak sales hours, you can count on uninterrupted payment processing with zero downtime.

How EnKash Payment Gateway Benefits Merchants

Track Transactions Easily

Merchants can control business payments with real-time access to daily, weekly, monthly, and yearly transaction summaries. Instantly view detailed histories, track payment statuses, and gain complete visibility over your collections.

Process Refunds & Reconcile Effortlessly

A full or partial refund can be initiated in just a few clicks while monitoring their status live. With real-time settlement reports, reconciliation becomes faster, simpler, and more accurate, saving you hours of manual effort.

Gain Actionable Business Insights

With access to real-time reports on cash flow, take data-backed decisions. Easily spot customer payment trends and receive instant alerts. Make informed choices that improve forecasting, prevent losses, and drive growth.

Integrating EnKash Payment Gateway

Website Integration

Plug-and-play code snippets or robust API integrations make it easy to embed the entire payment flow directly into your custom website with minimal effort.

WooCommerce & Shopify

Use ready-to-install EnKash plugins with guided, step-by-step setup. Go live in minutes without writing a single line of code.

OpenCart

Seamlessly integrate using EnKash’s official OpenCart extension or leverage SDKs for more customized implementations.

Mobile SDKs

Enable smooth in-app payments with SDKs for Android, iOS, React Native, Flutter, and Cordova, designed for quick integration and a frictionless user experience.

Know how to integrate with our API docs.

Solving Use Cases Across Industries: Payment Gateway for SMBs and Startups

Education

Educational institutions can transform fee collections with analytics-powered forms, automated reminders, branded payment links, DIY payment pages, split payments, and engaging cashback offers — all designed to simplify operations and enhance the payment experience for institutions and parents alike.

E-Commerce

Supercharge your online store with a sub-aggregator model, seamless iframe checkout, dynamic discounts, cashback campaigns, and split payments — backed by actionable insights to drive conversions and boost loyalty.

NBFCs & Digital Lenders

Optimize disbursements and collections with tools like UPI AutoPay, e-NACH, virtual accounts, pre-auths, and instant reconciliation; built for precision, compliance, and speed.

Financial Institutions

Automate collections and enhance operational efficiency with features like e-NACH, UPI 2.0, instant auto-collection, ePOS systems, account validation, and effortless split payments — tailored for banks and large-scale FIs.

Government & Public Sector

Enable smarter billing and collections with automated split payments, challan-based receipts, and support for NEFT/RTGS/IMPS; built to handle scale, compliance, and transparency.

B2B Supply Chain

Simplify complex B2B transactions with embedded finance tools, including corporate cards, digital credit lines, teller distribution, and revenue-based financing, helping you streamline vendor payouts and working capital.

Investments & WealthTech

Simplify SIPs and lump sum investments with UPI AutoPay, e-Mandates, real-time account validation, and automated reconciliation; designed for accuracy and investor confidence.

Insurance

Insurance companies can drive seamless recurring premium collections with UPI mandates and e-NACH. Enable instant refunds, smart reconciliation, and automated split payouts to agents and partners for a friction-free policyholder experience.

NGOs & Nonprofits

NGOs can accelerate donation collections via branded payment links, QR codes, and DIY donation pages. They can automate 80G receipt generation and improve donor trust and transparency.

Conclusion

A tech-savvy startup, a traditional business going online, or a growing D2C brand, EnKash Payment Gateway is for all. Backed by powerful tech, unmatched support, and security, this payment gateway lets you scale your way.

FAQs

What is EnKash Payment Gateway

An advanced tech-first payment gateway solution specially designed for Indian SMBs, startups, and enterprises.

Who can use the EnKash Payment Gateway?

Any business or institution looking to accept digital payments securely and efficiently can sign up for the EnKash payment gateway.

What payment modes does EnKash support?

UPI, debit/credit cards, net banking, wallets, EMI, and BNPL, among others

How is EnKash different from other payment gateways?

It offers 100% uptime, personalized support, deep customization, and bank-grade security.

Is EnKash Payment Gateway secure?

Without any second thoughts! It strictly adheres to PCI DSS standards and implements advanced encryption and tokenization.

How long does it take to get started with EnKash?

The onboarding is fast and effortless. Simply share the required documents, and our team will take care of the rest. Connect with us today!

Can EnKash be integrated into existing platforms or ERPs?

Yes, it supports a wide range of platforms and offers robust APIs for custom integrations.

What kind of support does EnKash offer during integration

Dedicated onboarding, technical documentation, integration kits, and 24×7 human support.

Can I use EnKash Payment Gateway only for collections?

No, you can also manage payouts, refunds, and get real-time analytics, making it a full-stack payment platform.