C

orporate Cards

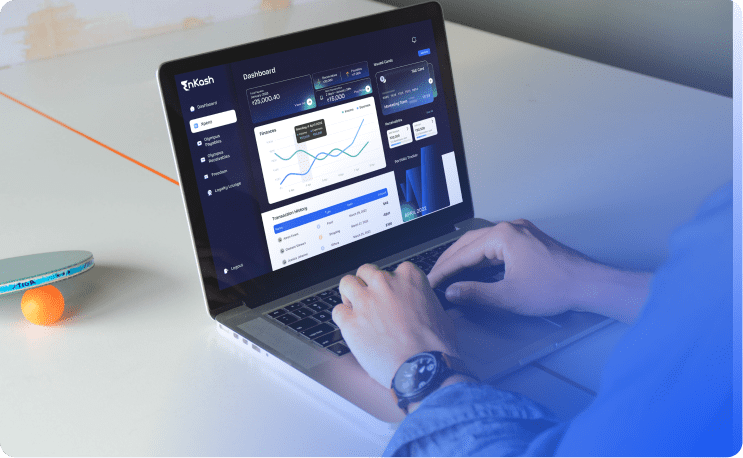

Purpose-built corporate cards

for all your

credit and prepaid needs

Set spend limits and controls, track real-time cash flow spends, streamline operations and reduce paperwork along with a DIY-card module

Set spend limits and controls, track real-time cash flow spends, streamline operations and reduce paperwork along with a DIY-card module

How does it work?

Corporate Credit Cards

Optimize cash flow, and gain valuable insights with a suite of tailored corporate credit card solutions like T&E cards

Explore Now

Prepaid Cards

Allocate easy-to-use prepaid cards like meal and fuel cards to your employees and simplify your business processes

Explore Now

Virtual Cards

Make it easy for your modern business to track and reconcile all payments with the new-age and innovative virtual cards

Explore Now

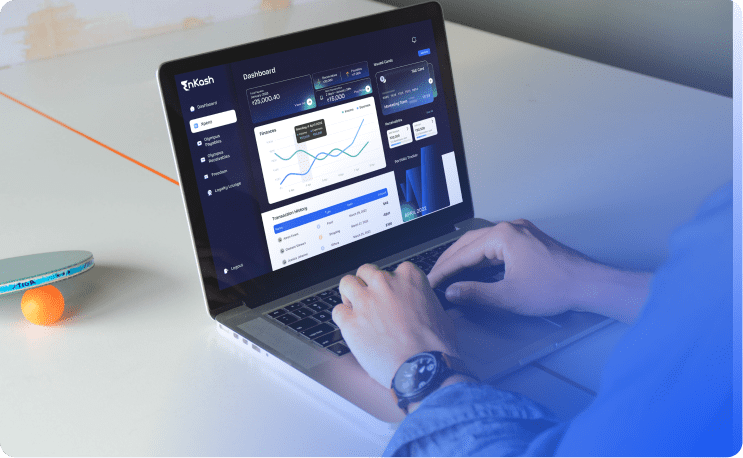

Manage business

expenses easily with EnKash

Reduced

Costs

Improved

Efficiency

Greater

Control

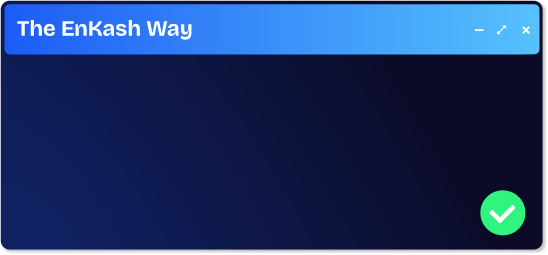

The EnKash way is

the better way

Switch to EnKash today!

Card

Issuance

Expense

Tracking

Reconciliation

Visibility &

Control

Employee

Experience

Card

Controls

Total

Control

Gain control over your business spends with a complete overview of all your expenses. Analyze data to create efficient budgets, optimize expenses and increase your savings.

Get Started

Card Management

Customizable Cards

Allocate Credit Limit

Smart

Platform

Quick Disbursement

Purposeful Prepaid Cards

Learn how corporate cards can benefit your business and employees!

Read Blogs

5 Reasons You Need Prepaid Credit Cards For Your Business

Sep 29, 2022

Many businesses that operate on a small and medium level have gained huge success and have been able to scale their company profitably with prepaid credit cards, as they are regarded as a powerful financial tool to manage...

Read More

Managing Credit Card for Company and its Spending: Tips and Strategies

May 17, 2023

Does your company have its very own credit card? If not, how do you make and track all the expenses for your business? Well, are you aware of the fact that credit card for company...

Read More

A Step-by-Step Guide for Virtual Card Business

Feb 22, 2023

A fascinating step towards sound business spending are virtual credit cards. They provide businesses with a safer, more personalized, and transparent way to pay for rent, vendors, GST, bills, and many other things. A company can make purchases...

Read More

Got Questions?

Don't worry! Our FAQs section will help you learn about corporate business cards in detail

What are corporate cards in India?

Corporate cards in India are primarily similar to personal credit cards. However, corporate cards are used exclusively for business-related purposes. With corporate cards, businesses can have easy access to funds. With smart usage, the business can enjoy a certain period of free credit within the billing cycle to pay for immediate requirements without having to arrange for working capital funds.

Who can get a corporate card?

Corporate cards are given to companies with a reasonable financial history. The business must have existed for at least a year with a distinct address and documents that validate its existence, like a registration certificate, partnership deed, or equivalent document. Banks that issue corporate cards also consider the promoters' eligibility and financial statements to strengthen the case. Many fintech companies have partnered with banks to help get corporate cards and manage them from end to end.

What is a virtual card?

A virtual card is available in a virtual format, not in a physical form. The use of virtual cards started with the need to enable safe and speedy online transactions. Unlike a physical card with the risk of being misplaced, lost, or stolen, virtual cards can be kept safe with password-protected access.

Do virtual cards enable POS transactions and ATM cash withdrawals?

Virtual cards are primarily designed for online transactions and may not be suitable for in-person point-of-sale (POS) transactions or ATM cash withdrawals. However, some virtual card providers may offer a physical card linked to the virtual card account, which can be used for in-person transactions and cash withdrawals.

How can I get a virtual card?

You can sign up on EnKash to get a virtual card for your business. After signing up, enter your required details and complete your KYC. The virtual card will be generated as soon as your verification is done. Create a PIN for its usage, transfer funds from your primary account to this virtual card, and use it freely for online purchases.

What is a prepaid card?

A prepaid card is a type of payment card that functions similarly to a debit card, but instead of being linked to a bank account, it holds a predetermined amount of funds that must be loaded onto the card before it can be used. Prepaid cards offer a secure and convenient way to manage spending and can be used for a variety of purposes, including making purchases, paying bills, and more.

How do prepaid cards work for businesses?

Prepaid cards offer businesses a flexible and efficient way to manage expenses and provide financial resources to employees. Companies can distribute prepaid cards to employees for use in making business-related purchases. This helps in budgeting and controlling expenses, as the cards can be preloaded with specific amounts. Additionally, businesses can track and monitor transactions, ensuring transparency and accountability.

What are the features and benefits of prepaid cards?

Prepaid cards offer various features and benefits:

No Credit Check: Prepaid cards do not require credit checks, making them accessible to individuals with varying credit histories

Reloadable: Users can reload funds onto the card, allowing for continued use over time

Security: Prepaid cards offer enhanced security compared to cash, minimizing the risk of loss or theft. In case of loss or theft, the card can be promptly deactivated

Budget Control: Prepaid cards promote budget control by limiting spending to the amount loaded onto the card

Convenience: Prepaid cards can be used for a variety of transactions, including online and in-store purchases, bill payments, etc

x

xSeeking further understanding of corporate cards?

Customizable cards for corporate expenses

These purpose-built business credit, prepaid, and virtual cards have been designed for various corporate needs such as travel, marketing, SaaS, fuel, meals, etc. Powered by banks and financial institutions, these cards enable customization along with setting spending limits and tracking in real time.